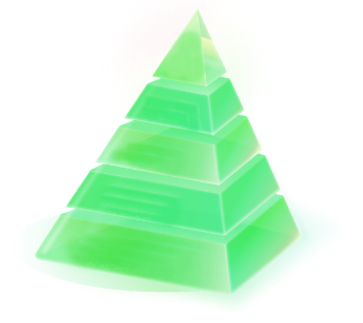

我们的策略

市场现状

纯量化投资很强吗?

一个无敌的基金经理可以永远跑赢市场吗?

量化投资

策略趋同,

算力占用越来越大,

抢单速度要求越来越快,

严重内卷!

算力占用越来越大,

抢单速度要求越来越快,

严重内卷!

主动投资

难以避免随市场大幅波动,

一旦理念出现问题,

或个股出现风险,

会面临大幅损失。

一旦理念出现问题,

或个股出现风险,

会面临大幅损失。

我们的投资理念

我们创造性地采用了大数据清洗技术,将市场交易人群的特征进行画像,

通过AI对过去、现在及未来的交易进行模拟,最后人工加上驱动因子及调整驱动因子的配比。

将理性市场数据与人脑的感性抉择,进行完美结合,实现更稳健良好的投资收益。

市场数据清洗 交易人群画像 模拟交易行为

AI系统

+驱动因子 人工抉择

人工抉择  理想交易

理想交易

人工抉择

人工抉择  理想交易

理想交易