核心团队

国际化: 凯德晟的服务人员,曾就职于欧美私人银行等专业机构,毕业于欧美知名院校,拥有丰富的国际投资市场经验。

专业化: 凯德晟的服务人员,包括精算师、信托专家、“BAT"背景的算法工程师等尖端人才。

交易系统

一站式的交易服务让您可以享用到多家私人银行和券商的产品及交易服务。

全权委托账户

经验丰富的投资经理,将为您提供量身定制的投资建议。投资组合监控与定期审查相结合,以确保投资活动始终符合您的投资预期。

香港OFC基金

凯德晟提供一站式香港OFC基金注册和管理服务, 让您可以拥有您的专属基金。在确保您对基金的绝对控制前提下,减轻您处理日常监管事宜所需耗费的精力和高昂的营运成本。

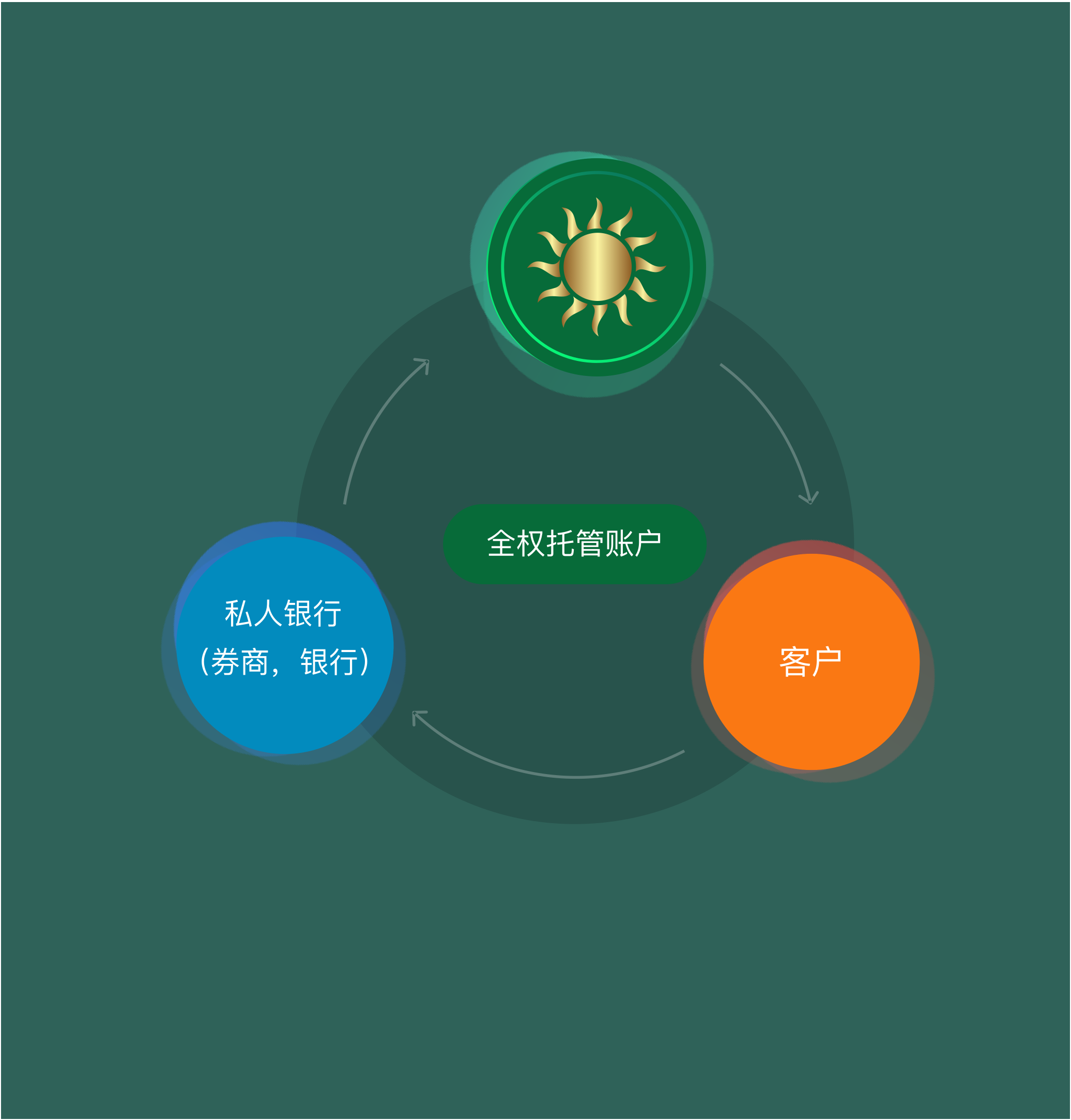

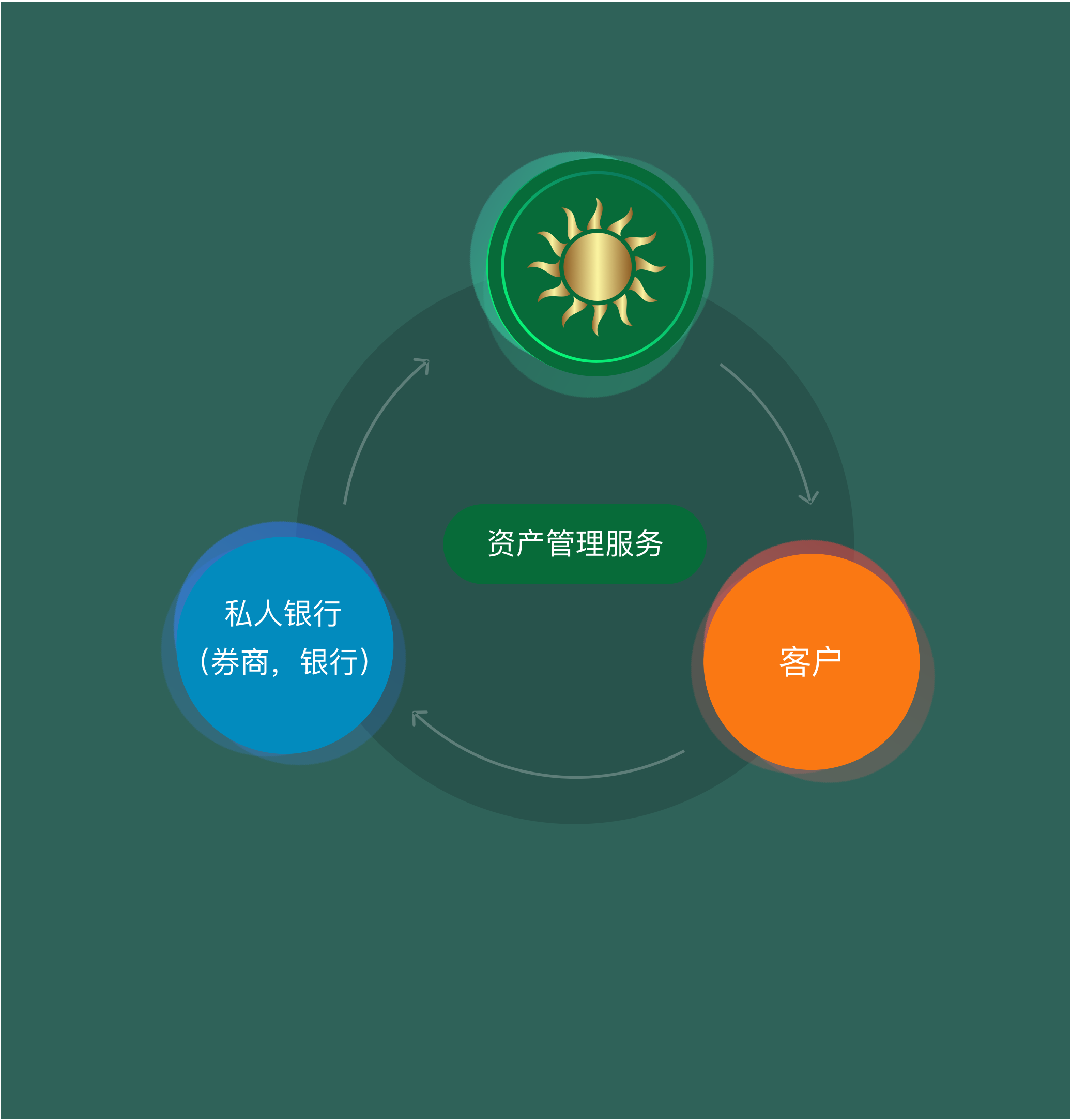

资产管理服务EAM

凯德晟已与国际一线私人银行建立了资产管理业务的合作关系,其中凯德晟作为独立的资产管理顾问,帮助您在私人银行开立账户和管理资产。

信托服务

凯德晟与专业的信托公司和税务师合作,协助您设立家族信托和管理家族资产,与您一起设计资产传承方案和进行全球税务规划,使您的家族资产得到长久传承。

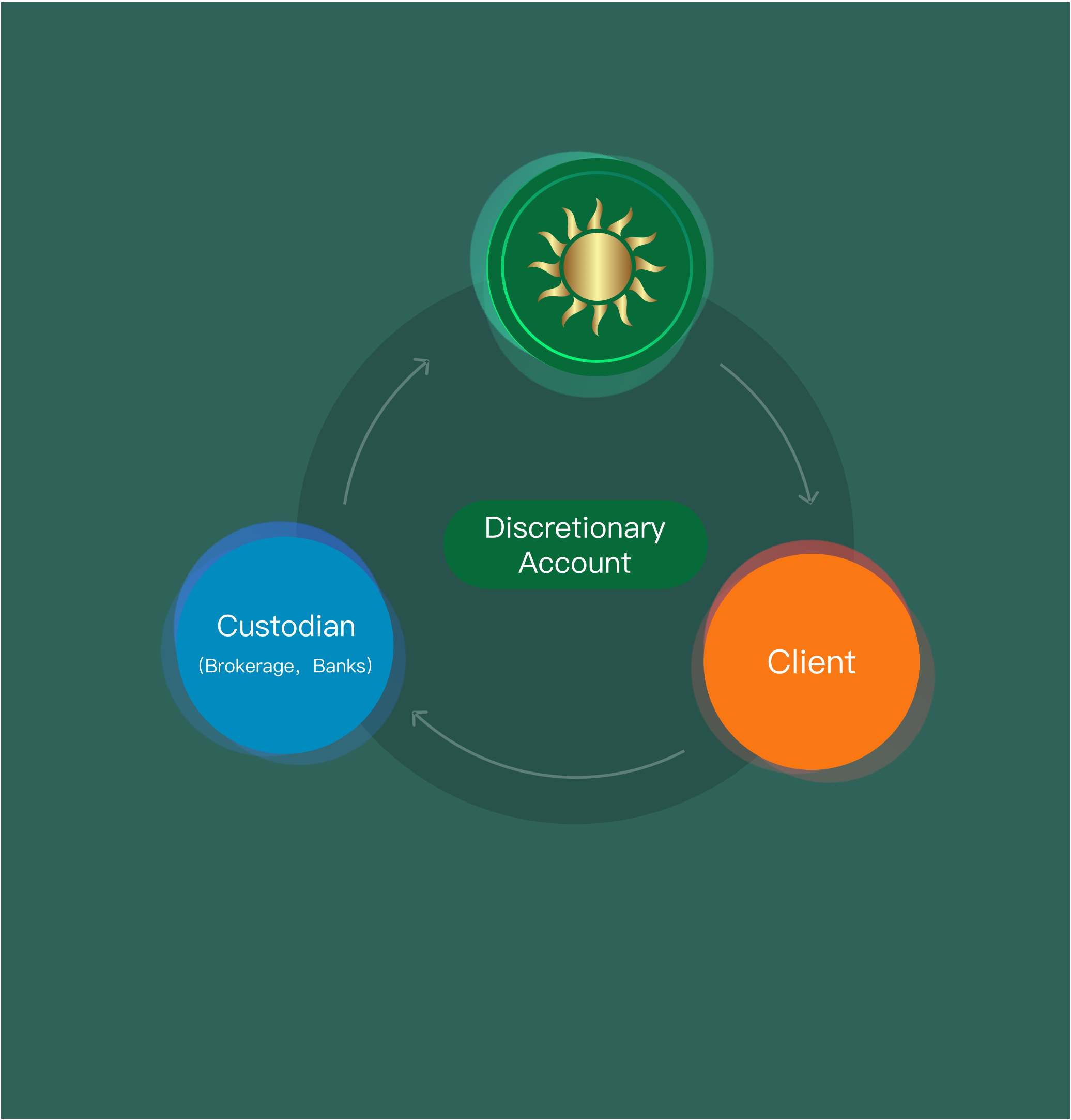

全权委托账户是什么?

如果您已在其他机构有账户,可以直接签个全权委托投资协议,委托凯德晟管理账户

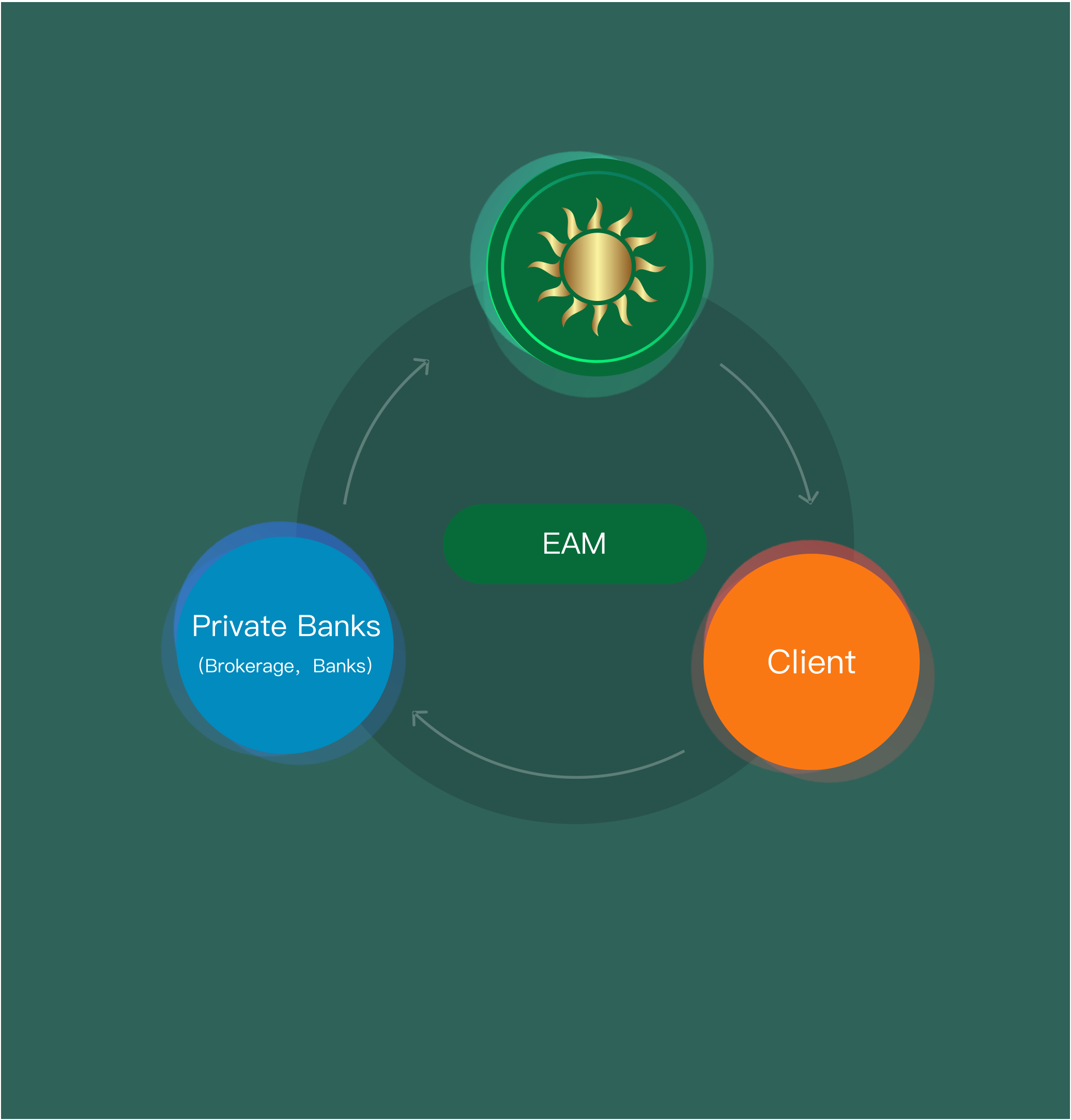

资产管理服务EAM是什么?

在EAM模式下,我们的客户以个人名义在总部位于香港、新加坡或瑞士的国际私人银行平台上开立银行账户、存储个人资产,由银行提供托管和经纪服务。凯德晟的客户经理在充分了解客户的投资目标和风险承受能力的情况下,帮助客户选择最适合的私人银行服务和投资配置方案。

在强大的投资管理团队支持下,凯德晟在资产管理服务方面的投资业绩表现卓越。我们有一支专业的投资管理团队,自有的分析师、研究员、金融工程师以及特定领域的专家为客户提供强大的投资管理智囊团,涵盖了全球股票、固定收益、多元化资产以及另类资产投资等领域。通过创新的专有投资策略分析模型、严谨的投资筛选流程和有效的投资组合管理模式,帮助客户实现资产的长久稳健增长。

信托服务

我们与专业的律师、信托公司、税务咨询师合作,为客户提供一系列信托架构解决方案,从简单的遗嘱信托和单一家族信托到更为复杂的跨境信托,例如Deferred Sales Trusts, Guarantor Trusts, Non-Guarantor Trusts等。

客户可以将在其他金融机构设立的账户,通过与凯德晟签立全权委托投资协议,由凯德晟管理账户投资事宜。

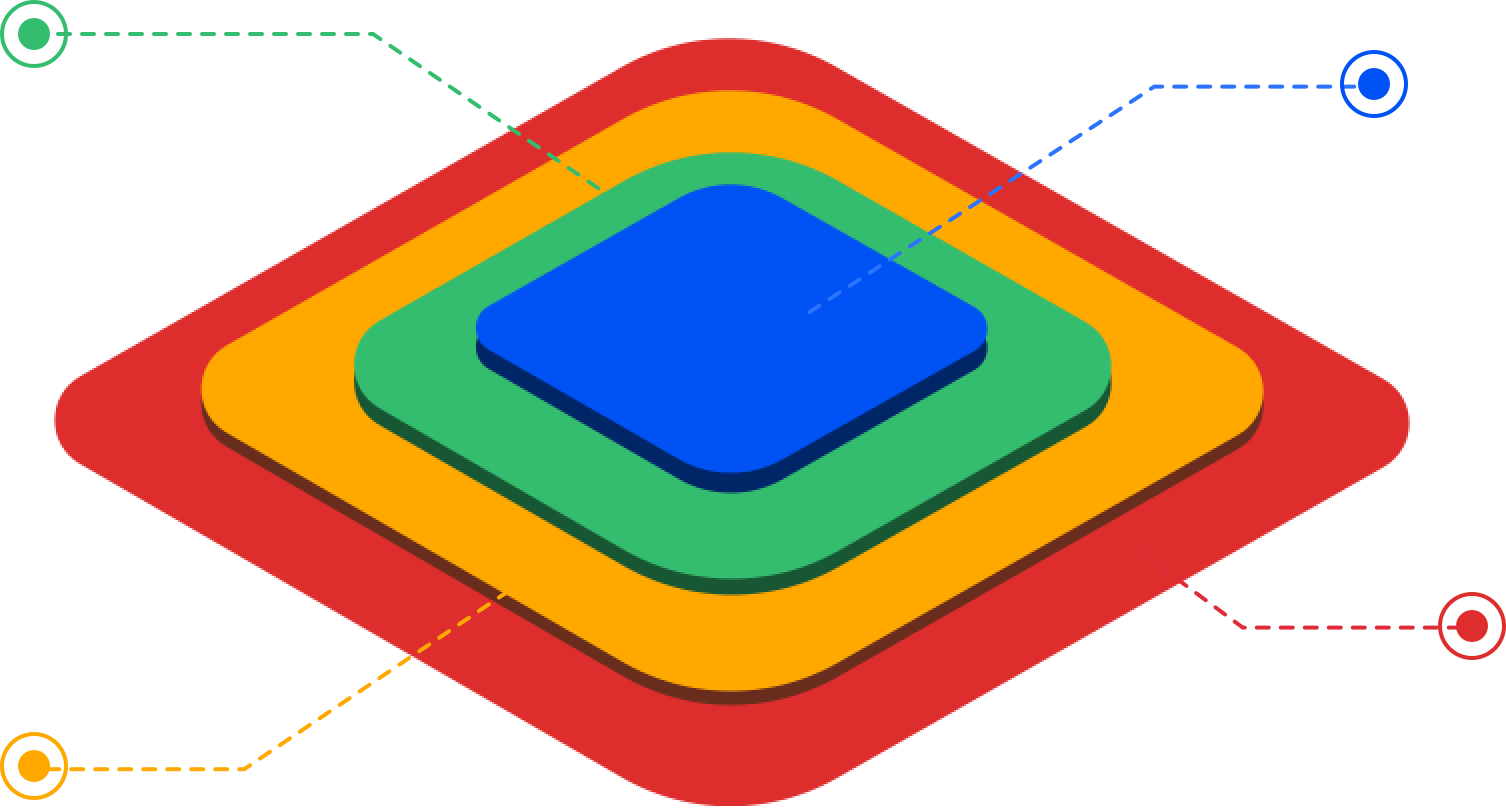

OFC基金注册

定制基金结构和规模,

一站式解决SFC的一切问题中介机构

以市场最佳条件对接好所有基金

运作所需的中介机构,包括

律师、审计师、银行、托管人等

资产管理

提供定制投资策略,由经验丰富的

投资公司带来贴身服务市场推广

利用互联网营销吸引更丰

富的投资人,有效推销基

金产品